Land depreciation calculator

First one can choose the straight line method of. Use this depreciation calculator to forecast the value loss for a new or used Land Rover.

Macrs Depreciation Calculator Straight Line Double Declining

It provides a couple different methods of depreciation.

. Select the currency from the drop-down list optional Enter the. The formula of the depreciation and appreciation is the same rates are either below zero depreciation or above zero appreciation. The calculator also estimates the first year and the total vehicle depreciation.

The smart depreciation calculator that helps to calculate depreciation of an asset over a specified number of years also estimate car property depreciation. Chemicals - Expenses related to chemicals such as herbicide. All you need to do is.

C is the original purchase price or basis of an asset. The MACRS Depreciation Calculator uses the following basic formula. See new and used pricing analysis and find out the best model years to buy for resale value.

Depreciation Schedule - Any farm machinery or building depreciation or other capital deprecation associated with this property. Where Di is the depreciation in year i. Use this depreciation calculator to forecast the value loss for a new or used Toyota Land Cruiser.

By entering a few details such as price vehicle age and usage and time of. D i C R i. It is fairly simple to use.

Land and building depreciation allow the taxpayer to recover the cost of the investment over a set period of time. The 2016 is our top pick for the best model year value for the Land Rover vehicles. Straight Line Depreciation Method.

This depreciation calculator is for calculating the depreciation schedule of an asset. Calculate car depreciation by make or model. The formula for calculating appreciation is as.

By entering a few details such as price vehicle age and usage and time of your. Choose a depreciation method for buildings MACRS or. The four most widely used depreciation formulaes are as listed below.

Depreciation asset cost salvage value useful life of asset. With the 2016 you would only pay on average 44 of the price as new with. Also includes a specialized real estate property calculator.

Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules.

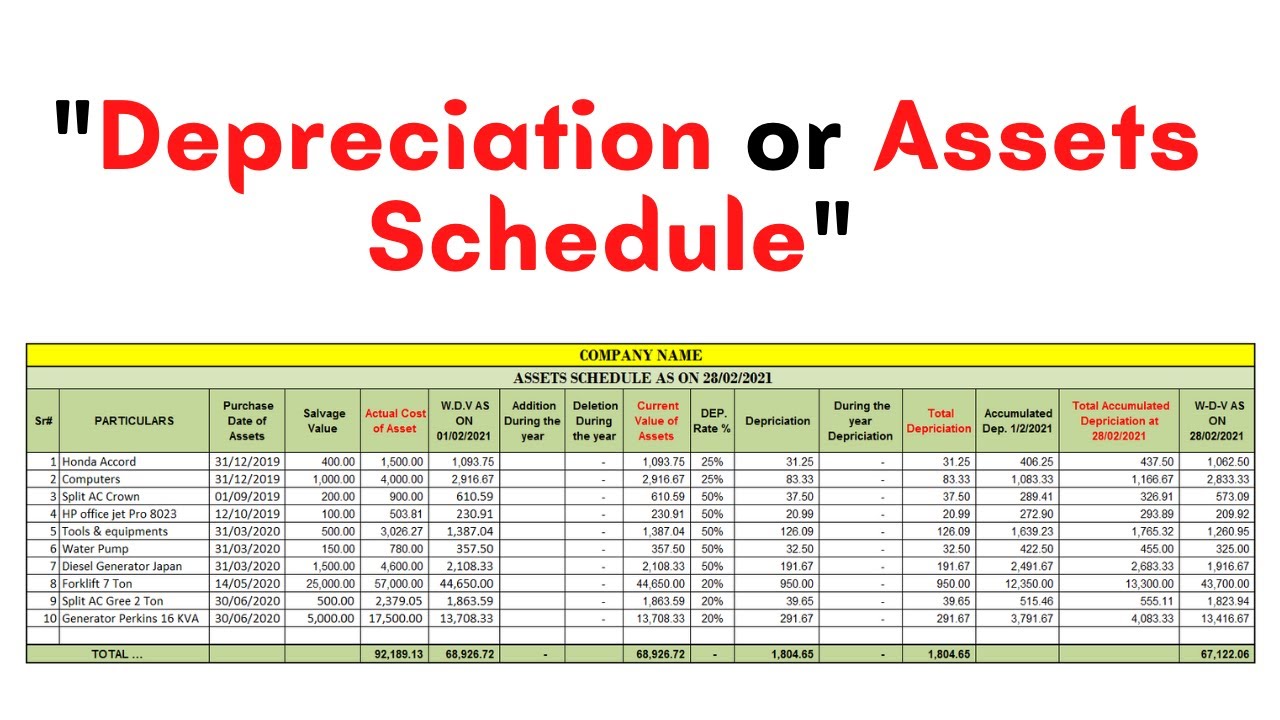

How To Prepare Depreciation Schedule In Excel Youtube

How To Use Rental Property Depreciation To Your Advantage

How Is Property Depreciation Calculated Rent Blog

Rental Property Depreciation Rules Schedule Recapture

What Is A Quantity Surveyor What Do They Do And How Can They Help You 2022 Guide Duo Tax Quantity Surveyors

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

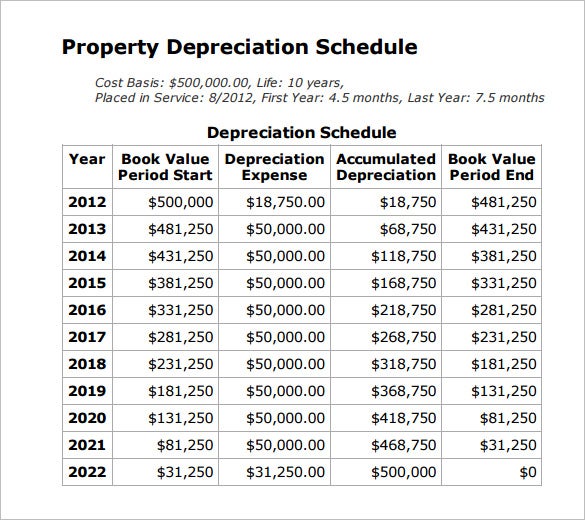

Depreciation Schedule Template For Straight Line And Declining Balance

Depreciation And Off The Plan Properties Bmt Insider

A Guide To Property Depreciation And How Much You Can Save

Free Construction Cost Calculator Duo Tax Quantity Surveyors

Free Macrs Depreciation Calculator For Excel

Section 179 For Small Businesses 2021 Shared Economy Tax

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Macrs Depreciation Calculator With Formula Nerd Counter

How Depreciation Claiming Boosts Property Cash Flow